- Frequently Asked Questions (FAQ)

- Assets

- Branches

- Customers

- Overview

- Adding Customers

- Billing and Invoices

- Customer Arrangement and Terms

- Customer Fields

- Customer Status and Categories

- Delete or Disable Customers

- Delete or Disable Customer Contacts

- Manager Field

- Marketing and Sales

- Messaging Customers

- Sub-Customers

- View Customer Pop-up Window

- Customer Requests

- Customer Opt-In and Opt-Out

- Dashboards

- Devices

- Expenses

- Inbound REST API

- Inventory

- Overview

- Barcode Reader for Warehouse Inventory

- Barcode SKU

- Export Inventory

- Inventory Accounting

- Inventory Audits

- Inventory Movements

- Inventory and Parts

- Importing Product Inventory

- Remove Parts From Inventory

- Invoices

- Mailchimp

- Notifications

- Parts

- Payments

- Purchase Orders

- QuickBooks

- Quotes

- Recurrent Routes

- Recurrent Services

- Reminders

- Reports

- Review Us

- Sage

- Sales Tax

- Schedule and Dispatching

- Screen Recording

- Services

- Support Tickets

- Telematics

- Text Messaging

- Time Tracking

- Trial Account

- Troubleshooting

- User Settings

- Overview

- Account Settings

- Account Users

- Connectors

- Custom Fields

- Display User Device Location on Map

- Documents and Email

- Google and Outlook Integration

- Import and Export Excel Documents

- Max Session Idle Time for Users

- Permissions Template

- Saved Login and Session Management

- Saved Searches

- Single Sign-On (SSO)

- Updating the User Password

- User Locked Out

- User Preferences

- MobiWork Locations

- User Interface

- Work Orders

This section will highlight how to set up sales tax for your company.

Please note that MobiWork partners with Zip Tax. Zip Tax provides, free of charge, over 42,000 sales tax percentages based on the customer’s zip code. MobiWork also partners with Avalara for more advanced sales requirements. For more information about our Avalara connector, please see the Avalara Connector page.

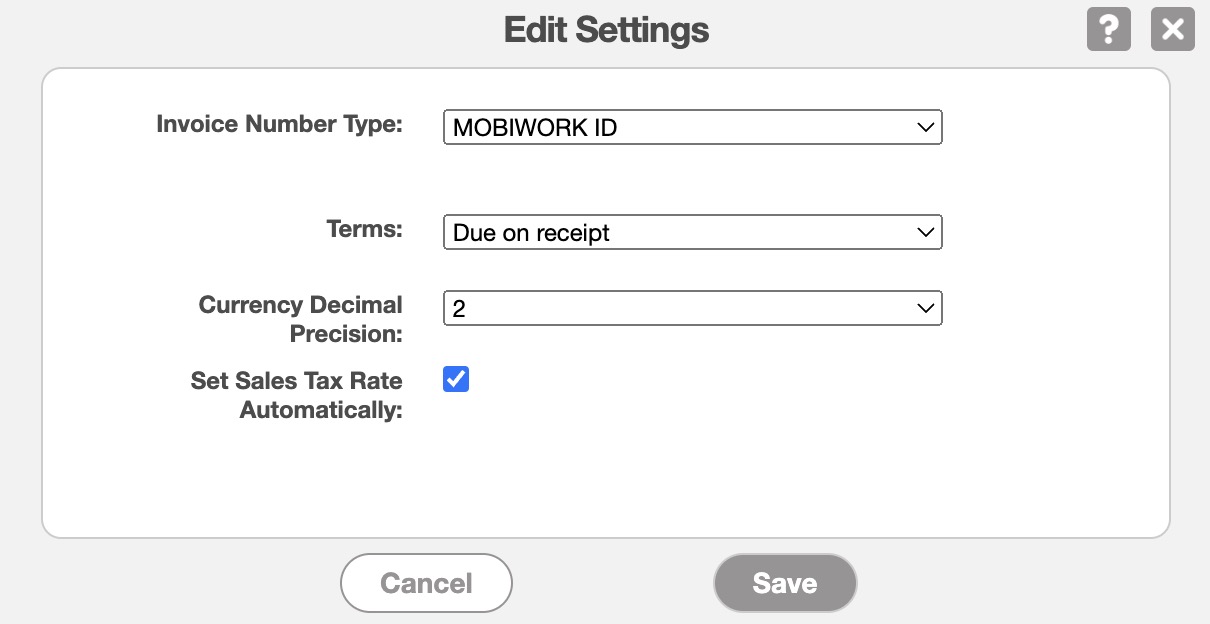

You can set up an automatic sales tax within your MobiWork web application. For more information on how to accomplish this, please see the General section on the Invoice Settings page:

Please note, that if this setting is off, you will be able to change the tax rate on a per invoice basis.

MobiWork automatically calculates sales tax based on the zip code. If there are multiple sales tax in the same code, then MobiWork will use the specified city.

MobiWork also provides a catalog of parts and services where you can specify if the individual part or service is taxable or not. For more information on modifying the sales tax for a part or services, please refer to the following pages: Add a Part, Edit Parts, Add Service, or the Edit Services.

Additionally, you can override the sales tax amount used in any quote or invoice. For more information on how to do update the invoice's or quote's sales tax, please see either the Add an Invoice page or the Add Quote page.

Instead of an automatic sales tax, you can manually set up a sales tax for your customers and parts & services.

You can access these settings by editing the selected customer, or by editing/adding your parts & services. For more information about editing your customers or parts/services, please see the Edit Customer(s) page, Add a Part or Service page, or Edit Parts & Services page.

If you have any questions or need further assistance, please let us know. We'd be happy to help!